More about GIIMs Digital Insurance Program

Insurance is not what it was even a few years ago. Understanding emerging information technologies and their impact on the insurance industry, and the roles and responsibilities of IT and non-IT stakeholders in leveraging these emerging technologies in light of the digital transformation, will be at the heart of all of the courses.

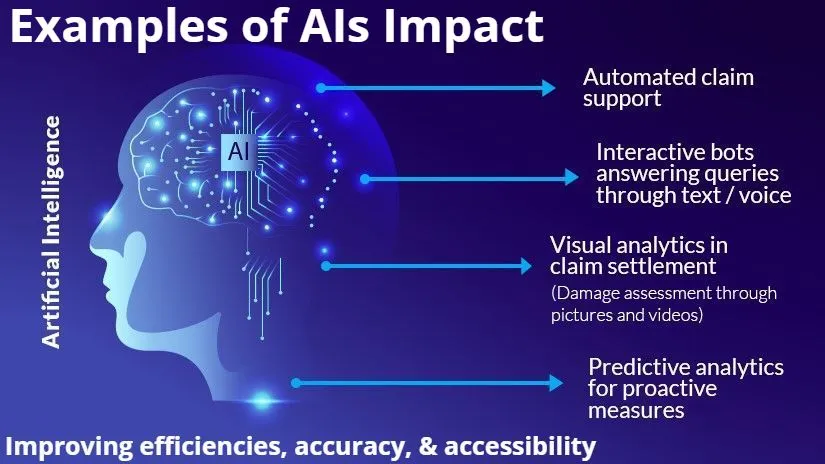

As artificial intelligence reshapes how insurance organizations operate and compete, the central question is no longer whether AI will replace human capability, but how leaders will integrate the strengths of both to unlock new levels of innovation, productivity, and enterprise value. The future is not a choice between humans or AI; it is a leadership challenge of orchestrating the best of both.

GIIM’s programs are designed precisely for this moment. They equip insurance leaders to harness the combined potential of human intelligence and artificial intelligence, ensuring each amplifies the other to drive measurable business impact.

-

Leverage explosion of data from connected devices

2. Streamlines Processes

a. Claims processing

b. Personalized insurance policies

c. Underwriting services

d. Customer service

e. Efficient insurance operations

f. Insurance for service drivers

g. Assessing vehicle damage

h. Determining property risks

i. Selecting health benefits plans

j. Invoice Processing

3. Reduce Biases

4. Offer Personalized/Flexible Options

5. Promotes Safer Habits (e.g., driving, health)

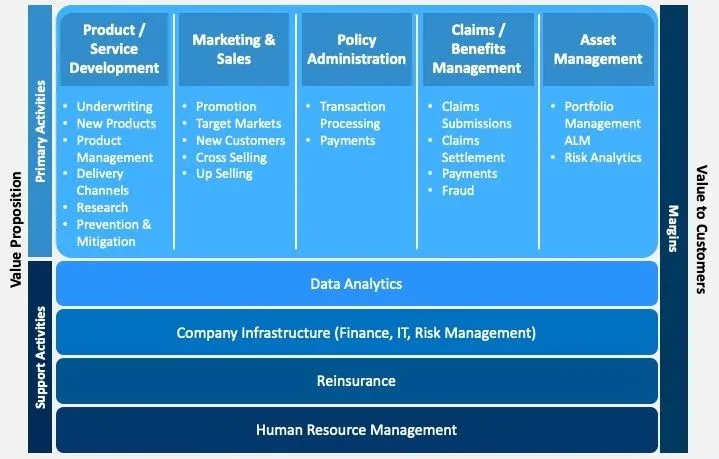

An explosion of technology innovation over the last several years has created digital-savvy consumers and digital-empowered employees. For the insurance sector, this has brought forth both new market opportunities and new market confusion.

The insurance sector has leveraged digitization for new ways of working, and that has proven to be especially valuable in light of the current environment. Insurers have also leveraged digitization to expand their products and services portfolio. In this digital environment, the trusted advisor is not necessarily available to help the consumer digest and understand the fine print. As a result, consumers now need to make decisions themselves without the benefit of having an advisor explain the value, which has resulted in a consumer gap in awareness and understanding of the products and services being offered. This creates a need for more digital solutions that can often replace the trusted advisor — for example, chatbots or artificial intelligence (AI) capabilities — to simplify the process.

What Manager Need To Know

The demand for more innovative ways to close the gaps in consumer awareness of products, services and their value propositions has become essential. This includes facilitating consumers ability to understand their own risks, the safeguards and rigors within the industry, as well as the value of newer offerings.

While insurers have used their websites extensively to help consumers better understand their offerings, the new digital ecosystem of tools and services offers a much greater variety of capabilities to segment and personalize experiences, while also recommending services tailored to individual needs. This augments the services typically provided by an agent in a face-to-face setting.

Management Competencies

In essence, the digital ecosystem allows insurers to creatively place themselves in the moment — at the time in a consumer’s life when risks happen (or have the potential to happen) — to offer relevant, personalized awareness, education, advice and services.

Emerging technologies are also having a profound impact on actuarial and back-office processes.

All of this still needs to be done within the confines of the regulations of state, federal and international governing authorities.

By leveraging emerging information technologies (e.g., big data, analytics, blockchain, robotics automation, AI), insurance firms are providing new services that automate the entire ecosystem securely and transparently. They are driving intense changes in competition and regulation.

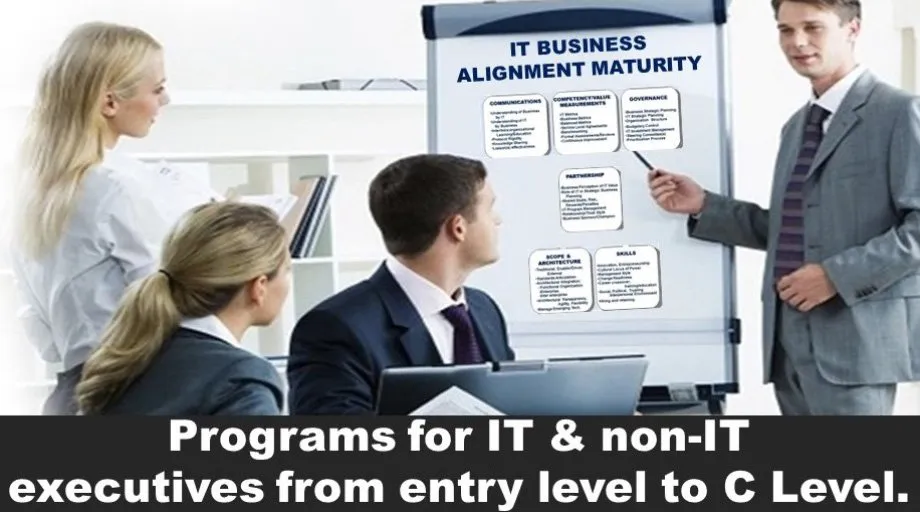

These changes present many opportunities and challenges. This has raised the demand for IT professionals with not only the proper technical background, but also advanced knowledge of management, industry, and interpersonal skills; especially regarding how to leverage IT in the insurance industry. Non-IT professionals also require increased proficiency in how best to leverage IT across the enterprise. Managers from all parts of the enterprise are being called upon to work together to address these complex business and technical challenges. Preparing IT and non-it professionals with these necessary skills has become essential, in light of the digital transformation and emerging information technologies.

- Naturally, having accurate, accessible, secure data is fundamental to a successful AI initiative, thus providing additional topics addressed in this program.

- The courses are designed for IT and non-IT professionals in the Insurance industry whose roles involve leveraging digital services opportunities to provide demonstrable value from their IT investments, in light of the digital transformation and emerging information technologies (e.g., blockchain, social media, analytics, big data).

- Given the diversity of the Insurance industry (e.g., life, homeowners, health, auto, liability), and the background of the candidates, GIIM will work with you to ensure all objectives are attained.